First, let's break down exactly what goodwill means. When business owners say “goodwill” they usually mean economic goodwill and not accounting goodwill, which is a plug number on a balance sheet.

Economic goodwill refers to the the fair market value of a business that is over and above the value of its tangible assets and its identifiable intangible assets. IMPORTANT: NOT all businesses have goodwill. Only those businesses that can generate sufficient cash flow such that the present value of the cash flow exceeds the value of their net tangible assets and identifiable intangible assets have goodwill.

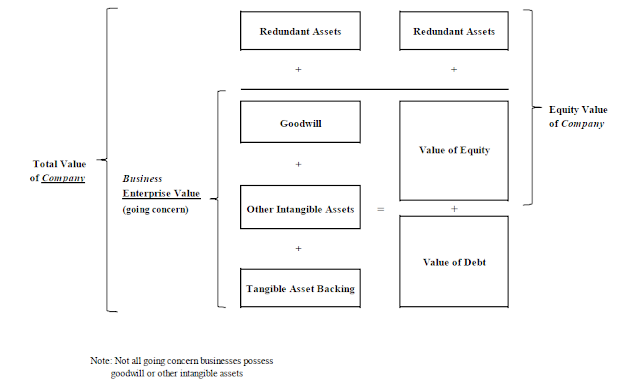

See the chart below for an illustration:

Keystone Business Valuations is located in Burlington, Ontario and we provide professional business valuation & litigation support services such as business valuations for corporate reorganizations, tax, estate, divorce, disputes, oppression. We can also assist with quantifying economic losses. Serving Toronto, the GTA, Oakville, Burlington, Hamilton, Niagara, the KW region and across southern Ontario. Please visit us at www.keystonebv.ca or call us at 905-592-1525.

Wednesday 29 June 2016

Business Goodwill - What's It Worth?

Labels:

business valuation,

goodwill

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Divorce and the Division of Property - How to Equalize Assets

In Ontario, when a married couple divorces and assets need to be divided, there is generally an equalization payment that is made from a payor spouse to a payee spouse in order to equalize the increase in the spouses' net family property.

The increase in net family property is essentially the net property (assets less liabilities) each spouse owned at the date of separation, less the net property they owned at the date of marriage.

Example – if John and Mary each had $0 (or very close to $0) in property when they married and then at the date of separation John owned $1,500,000 in net property and Mary owned $500,000 in net property, then John would be required to make $500,000 equalization payment to Mary. After the $500,000 payment they would each have $1,000,000 in net property (equal).

It is important to note that if John owned a specific asset that Mary could not demand to be compensated with that asset on demand (example – if John owned an investment property in his name, Mary could not demand that John sign it over). What Mary would be entitled to receive is an equalization payment that equalizes the value of net family property as at the separation date.

The increase in net family property is essentially the net property (assets less liabilities) each spouse owned at the date of separation, less the net property they owned at the date of marriage.

Example – if John and Mary each had $0 (or very close to $0) in property when they married and then at the date of separation John owned $1,500,000 in net property and Mary owned $500,000 in net property, then John would be required to make $500,000 equalization payment to Mary. After the $500,000 payment they would each have $1,000,000 in net property (equal).

It is important to note that if John owned a specific asset that Mary could not demand to be compensated with that asset on demand (example – if John owned an investment property in his name, Mary could not demand that John sign it over). What Mary would be entitled to receive is an equalization payment that equalizes the value of net family property as at the separation date.

Labels:

divorce

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Top 10 Finance and Business Valuation Terms for Newbies

There is a lot of jargon that is thrown around in the world of finance and business valuation. This blog post attempts to lift the veil on some of the more commonly used finance & business valuation terms. Although there are many, many more terms that could be included on this list, these listed below are but a sample....

1. EBITDA – it stands for Earnings Before Interest, Taxes, Depreciation and Amortization. To calculate the EBITDA of a business you would take the net income of the business and add back the interest expense, income taxes, depreciation & amortization. EBITDA is an “unlevered” measure of profit – it is a profit measure before interest expense is deducted. It is intended to be a proxy for pre-tax cash flow but it does have some deficiencies such as not accounting for capital expenditures, changes in net working capital or differing tax rates.

2. Enterprise Value – in business valuation, Enterprise Value (EV) refers to the total value of a company, its debt and its equity combined. The theory is that EV is a measure of a company's total worth without the 'noise' associated with its capital structure. Using a house as an analogy... if your home was appraised to be worth $1 million and you had a $600,000 mortgage on it then the 'EV' of your house would be $1 million and the equity value of the home would be $400,000 ($1 million less $600,000). To calculate the equity value of a business you would subtract business debt from its EV.

A commonly used business valuation ratio is the Enterprise Value / EBITDA ratio. Example - if a business is valued at $400,000 Enterprise Value and has an EBITDA of $100,000 then the EV/EBITDA ratio would be 4x. This ratio could then be compared to industry peers.

1. EBITDA – it stands for Earnings Before Interest, Taxes, Depreciation and Amortization. To calculate the EBITDA of a business you would take the net income of the business and add back the interest expense, income taxes, depreciation & amortization. EBITDA is an “unlevered” measure of profit – it is a profit measure before interest expense is deducted. It is intended to be a proxy for pre-tax cash flow but it does have some deficiencies such as not accounting for capital expenditures, changes in net working capital or differing tax rates.

2. Enterprise Value – in business valuation, Enterprise Value (EV) refers to the total value of a company, its debt and its equity combined. The theory is that EV is a measure of a company's total worth without the 'noise' associated with its capital structure. Using a house as an analogy... if your home was appraised to be worth $1 million and you had a $600,000 mortgage on it then the 'EV' of your house would be $1 million and the equity value of the home would be $400,000 ($1 million less $600,000). To calculate the equity value of a business you would subtract business debt from its EV.

A commonly used business valuation ratio is the Enterprise Value / EBITDA ratio. Example - if a business is valued at $400,000 Enterprise Value and has an EBITDA of $100,000 then the EV/EBITDA ratio would be 4x. This ratio could then be compared to industry peers.

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Business Valuation - K.I.S.S.

There is a misconception that many people have that the more quantitative and complex a business valuation model, the better the business valuation final conclusion will be. The reality is usually quite different, especially when analysis-paralysis sets in. Sometimes the K.I.S.S. principle is a good one to remember.

In reality, when an arm's length buyer and seller negotiate the purchase & sale of a business they usually do not go to great pains to calculate things like foregone tax shield, unlevered betas, equity risk premiums, size premiums, and so on. A buyer and seller in the heat of a negotiation will usually focus on things like:

These are the truly important issues to get right.

In reality, when an arm's length buyer and seller negotiate the purchase & sale of a business they usually do not go to great pains to calculate things like foregone tax shield, unlevered betas, equity risk premiums, size premiums, and so on. A buyer and seller in the heat of a negotiation will usually focus on things like:

- How sustainable is the cash flow of the business?\

- How risky is the business's source of earnings?

- How can the buyer transition the business to himself?

- Can they grow the business?

These are the truly important issues to get right.

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Friday 20 May 2016

The Income Tax Act - When is a Valuation Required?

WARNING: Dry blog post ahead....

Unless you're an accountant, tax specialist or a business valuator, you should probably stop reading now ;)

The Income Tax Act of Canada requires value to be determined for many different reasons. The most common reason that value needs to be determined for income tax reasons is for a corporate reorganization (more on that later).

First, below is a laundry list of most instances when the Income Tax Act would require value to be determined. Some are well known, others less so:

- Employee stock options

- Debts of shareholders and certain persons connected with shareholders (section 15)

- Capital gains & losses

- Purchase price allocation

Unless you're an accountant, tax specialist or a business valuator, you should probably stop reading now ;)

The Income Tax Act of Canada requires value to be determined for many different reasons. The most common reason that value needs to be determined for income tax reasons is for a corporate reorganization (more on that later).

First, below is a laundry list of most instances when the Income Tax Act would require value to be determined. Some are well known, others less so:

- Employee stock options

- Debts of shareholders and certain persons connected with shareholders (section 15)

- Capital gains & losses

- Purchase price allocation

Labels:

corporate reorganization,

income tax

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Equity Value vs. Enterprise Value vs. Company Value... What's the Difference??

There seems to be some confusion some people have regarding the differences between total company value, equity value and enterprise value. This blog post will attempt to clarify these differences.

The biggest challenge some people have is differentiating between business enterprise value and total company value. Really simple example... imagine a barbershop business that made $50,000 per year in profit and was valued at $100,000 (not a real valuation but bear with me). Imagine now that the barbershop business was owned by an Ontario corporation. Now let's pretend that this Ontario Corporation also had $300,000 in its bank account. This cash is not used or needed by the barbershop business - it is a redundant asset. The value of the barbershop business is still only $100,000; however, the total value of the Ontario corporation would be $400,000 ($100,000 for the barbershop business value + $300,000 in redundant cash it has in its account).

Looking at the Graphic below, it illustrates the components of value that are included in Total Company Value, the business Enterprise Value and the Equity Value of a company.

Graphic:

I will attempt to explain, at a high level, the various components of value in the graphic above.

The biggest challenge some people have is differentiating between business enterprise value and total company value. Really simple example... imagine a barbershop business that made $50,000 per year in profit and was valued at $100,000 (not a real valuation but bear with me). Imagine now that the barbershop business was owned by an Ontario corporation. Now let's pretend that this Ontario Corporation also had $300,000 in its bank account. This cash is not used or needed by the barbershop business - it is a redundant asset. The value of the barbershop business is still only $100,000; however, the total value of the Ontario corporation would be $400,000 ($100,000 for the barbershop business value + $300,000 in redundant cash it has in its account).

Looking at the Graphic below, it illustrates the components of value that are included in Total Company Value, the business Enterprise Value and the Equity Value of a company.

Graphic:

I will attempt to explain, at a high level, the various components of value in the graphic above.

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Tip to Valuing a Business - Get the Story Right!

One of the biggest misconceptions out there is that the process of valuing a business is really just a hardcore quantitative exercise that consists of endless excel spreadsheets with complex financial models. Sure, business valuation does have a quantitative slant to it and, yes, there are excel spreadsheets involved. However, the more important point to grasp is that at its heart, a business valuation is all about the future of a business, not its past. And... because the value of a business is about its future then that, therefore, requires a really strong grasp of the 'story' behind the business which is then translated in a quantitative analysis. Too many people, including some professionals, tend to put the cart before the horse and simply jump right into their financial modelling without trying to understand first the story behind the business that should be driving the numbers, not the other way around.

You need to know the story behind the numbers

Buyers of a business care about the future of the business. They care about the future cashflow that the business is expected to generate and they care about the riskiness associated with the future cashflow. As a business valuator, I look to the past results of the business only to the extent that they may help me to understand what the future of the business might look like.

You need to know the story behind the numbers

Buyers of a business care about the future of the business. They care about the future cashflow that the business is expected to generate and they care about the riskiness associated with the future cashflow. As a business valuator, I look to the past results of the business only to the extent that they may help me to understand what the future of the business might look like.

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Saturday 30 April 2016

Factoring Taxes into a Divorce Settlement

In Ontario, when a married couple goes through the divorce process there is normally an equalization payment required from one spouse to the other spouse. In the absence of a valid marriage contract that states otherwise, the spouses would be entitled to 50% of the increase in the total net family property value from the date of marriage up to the date of separation.

When contemplating the equalization payment there are some very important tax consequences to consider.

Simple example:

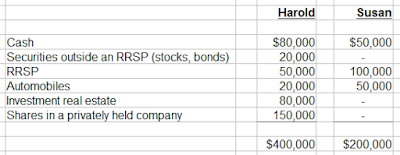

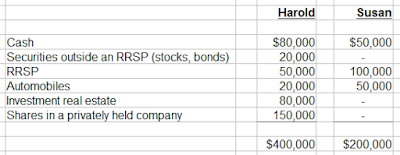

If it is determined that at the separation date Harold had $400,000 in net property and Susan had $200,000 in net property, then Harold would have to pay Susan $100,000 so that they each end up with $300,000 in value.

You'll notice in the example that Harold would have to provide Susan $100,000 in order to equalize the net family property value. To be clear though, if Harold provides $100,000 in cash to Susan that would NOT be the same as providing her with investment real estate that is appraised at $80,000 + $20,000 in cash. Why is that? Because of taxes. More on this later.

What is the property that is normally dealt with in a divorce? Let's examine the table below, which outlines the property that Harold and Susan each own at the separation date. Let's assume that they do not own a home, that they rent.

When contemplating the equalization payment there are some very important tax consequences to consider.

Simple example:

If it is determined that at the separation date Harold had $400,000 in net property and Susan had $200,000 in net property, then Harold would have to pay Susan $100,000 so that they each end up with $300,000 in value.

You'll notice in the example that Harold would have to provide Susan $100,000 in order to equalize the net family property value. To be clear though, if Harold provides $100,000 in cash to Susan that would NOT be the same as providing her with investment real estate that is appraised at $80,000 + $20,000 in cash. Why is that? Because of taxes. More on this later.

What is the property that is normally dealt with in a divorce? Let's examine the table below, which outlines the property that Harold and Susan each own at the separation date. Let's assume that they do not own a home, that they rent.

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Friday 22 April 2016

Divorce: How are Personal Guarantees on Business Debt Handled ?

It is a common situation where one spouse owns and operates a privately-held business and the non-owner spouse agrees to guarantee some portion of the business debt.

This blog post will examine how personal guarantees for business debt are dealt with in the context of a divorce.

The use of a simple example can illustrate some of the issues that are at play:

Suppose that a couple is going through a divorce. Assume the husband (Mr. John Smith) owns and operates a business through a privately-held company, of which he is 100% shareholder. Let's pretend this corporation has $100,000 in loans from the bank and that Ms. Nancy Smith has personally guaranteed the full $100,000. Nancy is NOT a shareholder of the company.

The question is, how is the personal guarantee from Nancy dealt with now that the couple are divorcing? Is it a liability for Nancy?

Possibly. It is a contingent liability. In other words, it is a liability that may come to fruition.... but may not.

This blog post will examine how personal guarantees for business debt are dealt with in the context of a divorce.

The use of a simple example can illustrate some of the issues that are at play:

Suppose that a couple is going through a divorce. Assume the husband (Mr. John Smith) owns and operates a business through a privately-held company, of which he is 100% shareholder. Let's pretend this corporation has $100,000 in loans from the bank and that Ms. Nancy Smith has personally guaranteed the full $100,000. Nancy is NOT a shareholder of the company.

The question is, how is the personal guarantee from Nancy dealt with now that the couple are divorcing? Is it a liability for Nancy?

Possibly. It is a contingent liability. In other words, it is a liability that may come to fruition.... but may not.

Labels:

divorce

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

What is a Right of First Refusal ??

When a privately-held company has more than one shareholder, a right of first refusal (“ROFR”... sometimes pronounced as "roofer") is an agreement among them as to how potential sales of shares to third parties are handled.

ROFRs provide procedures on how potential future share sales are managed.

Example:

Suppose Sam and Tom each own 50% of a privately-held company that produces video games. Tom is tired of dealing with Sam, and he wants to retire so he has found a buyer willing to pay him for his 50% of the company. Sam is not thrilled with this since he doesn't want to be stuck with a new 50% shareholder he knows nothing about. Also, Sam would like to own 100% of the company himself, if he can manage it. Sam remembers that when he and Tom executed their shareholders' agreement that there was a ROFR clause included in it. Sam has decided to exercise his ROFR and will pay Tom for his shares at the same price and terms that were offered to Tom by the third-party purchaser.

A background on rights of first refusal

There are essentially two types of rights of first refusal:

ROFRs provide procedures on how potential future share sales are managed.

Example:

Suppose Sam and Tom each own 50% of a privately-held company that produces video games. Tom is tired of dealing with Sam, and he wants to retire so he has found a buyer willing to pay him for his 50% of the company. Sam is not thrilled with this since he doesn't want to be stuck with a new 50% shareholder he knows nothing about. Also, Sam would like to own 100% of the company himself, if he can manage it. Sam remembers that when he and Tom executed their shareholders' agreement that there was a ROFR clause included in it. Sam has decided to exercise his ROFR and will pay Tom for his shares at the same price and terms that were offered to Tom by the third-party purchaser.

A background on rights of first refusal

There are essentially two types of rights of first refusal:

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Tuesday 29 March 2016

How is the Child Support Amount Determined in a Divorce?

In the divorce process in Canada, once the spouses have worked out the child access details, living arrangements, and so on there still remains the question of child support payments. More specifically, how is the actual dollar amount determined?

The parent who does not have the primary care responsibility for the child (or children) is usually responsible to pay child support to the parent that does. The amount of child support is determined based on the Federal Child Support Guidelines (“FCSG”), which is statutory.

The FCSG are set up to ensure a level of consistency and fairness when it comes to determining the actual amount of child support that must be paid. The FCSG provide guidance as to the procedures involved in calculating what is known as “guideline income” (i.e. the income amount used to determined child support). It is VERY important to understand that guideline income under the FCSG is not necessarily equal to accounting income or income you report on your tax return. Also, either party can request income disclosure from the other party once every year.

The parent who does not have the primary care responsibility for the child (or children) is usually responsible to pay child support to the parent that does. The amount of child support is determined based on the Federal Child Support Guidelines (“FCSG”), which is statutory.

The FCSG are set up to ensure a level of consistency and fairness when it comes to determining the actual amount of child support that must be paid. The FCSG provide guidance as to the procedures involved in calculating what is known as “guideline income” (i.e. the income amount used to determined child support). It is VERY important to understand that guideline income under the FCSG is not necessarily equal to accounting income or income you report on your tax return. Also, either party can request income disclosure from the other party once every year.

Labels:

divorce

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Friday 18 March 2016

How to Value a Business

This blog post will give a high level overview of the principles involved in valuing a privately owned business.

First thing to consider - is the business a going concern?

If the business is not expected to be able to carry out its financial obligations or remain viable, solvent and remain operating then generally the business would be valued on a liquidation basis.

In a liquidation basis, the assets would be valued at the amount they would be able to fetch if they were sold off, net of disposition costs, corporate debts, corporate taxes and personal taxes. In a liquidation approach, it is important to understand if it is to be a forced immediate liquidation or an orderly timely liquidation. In a forced liquidation the assets might not fetch as much money if they are to be sold off quickly, costs might be higher and generally the resulting valuation in a forced liquidation would be lower compared to an orderly liquidation.

However, if the business is a going concern, then there are three main approaches that could be used: the asset approach, the income approach or the market approach.

The Asset based approach

If the business you are trying to value does not have commercial goodwill, or if it is generating a return that is below what should normally be realized for the assets invested in the business but it is not quite at liquidation yet, then an asset based approach would probably be the primary approach to value the business.

In an asset based approach, generally the assets and liabilities on the company's balance sheet are restated to market values. There is some more nuance to this approach that involves some technical items like lost tax shield, deferred income taxes and other items but at a high level the idea is to restate the balance sheet to current value, make some technical adjustments to a few specific items, then the restated equity (also known as the adjusted book value) would be the resulting value. In an asset based approach the key point is that there is no economic goodwill in the business that is being valued. An asset based approach is also usually used when valuing a holding company.

Income based approach

If the business does have economic goodwill then you would likely want to look at valuing the business using an income based approach. In an income based approach, the business is valued using it's earnings or cashflow.

First thing to consider - is the business a going concern?

If the business is not expected to be able to carry out its financial obligations or remain viable, solvent and remain operating then generally the business would be valued on a liquidation basis.

In a liquidation basis, the assets would be valued at the amount they would be able to fetch if they were sold off, net of disposition costs, corporate debts, corporate taxes and personal taxes. In a liquidation approach, it is important to understand if it is to be a forced immediate liquidation or an orderly timely liquidation. In a forced liquidation the assets might not fetch as much money if they are to be sold off quickly, costs might be higher and generally the resulting valuation in a forced liquidation would be lower compared to an orderly liquidation.

However, if the business is a going concern, then there are three main approaches that could be used: the asset approach, the income approach or the market approach.

The Asset based approach

If the business you are trying to value does not have commercial goodwill, or if it is generating a return that is below what should normally be realized for the assets invested in the business but it is not quite at liquidation yet, then an asset based approach would probably be the primary approach to value the business.

In an asset based approach, generally the assets and liabilities on the company's balance sheet are restated to market values. There is some more nuance to this approach that involves some technical items like lost tax shield, deferred income taxes and other items but at a high level the idea is to restate the balance sheet to current value, make some technical adjustments to a few specific items, then the restated equity (also known as the adjusted book value) would be the resulting value. In an asset based approach the key point is that there is no economic goodwill in the business that is being valued. An asset based approach is also usually used when valuing a holding company.

Income based approach

If the business does have economic goodwill then you would likely want to look at valuing the business using an income based approach. In an income based approach, the business is valued using it's earnings or cashflow.

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

What is EBITDA?

Financial professionals are sometimes guilty of throwing around jargon without stopping to realize that most (normal) people might not know what they are talking about. EBITDA is one of those terms. Although it is fairly easy to define, there is some nuance to it. This blog post will attempt to shed some light on the financial term "EBITDA" and highlight why it is important.

What does E.B.I.T.D.A. stand for?

Earnings Before Interest, Taxes, Depreciation and Amortization.

EBITDA is an important financial measure of a business's profitability but you won't find it in an accountant's financial statement. The reason for this is that EBITDA is more of finance term than it is an accounting term. It is the profit that a business makes before any interest on debt, taxes or depreciation and amortization. It must be calculated separately from the information that is presented on your accountant-prepared financial statement.

So why go to the trouble of calculating EBITDA? Why not just use net income as reported on the financial statement?

There are a few reasons why you might want to calculate EBITDA versus relying on net income. The first reason is comparability. If you were analyzing several companies in an industry for their efficiency, profitability or relative valuation, net income would distort your analysis. The reason for this is that 2 similar companies with the same revenue and profit margins can report very different net income amounts. The reasons are that one company might be financed by a lot of debt and the other company might be financed by equity. The company that has debt would have interest payments that

What does E.B.I.T.D.A. stand for?

Earnings Before Interest, Taxes, Depreciation and Amortization.

EBITDA is an important financial measure of a business's profitability but you won't find it in an accountant's financial statement. The reason for this is that EBITDA is more of finance term than it is an accounting term. It is the profit that a business makes before any interest on debt, taxes or depreciation and amortization. It must be calculated separately from the information that is presented on your accountant-prepared financial statement.

So why go to the trouble of calculating EBITDA? Why not just use net income as reported on the financial statement?

There are a few reasons why you might want to calculate EBITDA versus relying on net income. The first reason is comparability. If you were analyzing several companies in an industry for their efficiency, profitability or relative valuation, net income would distort your analysis. The reason for this is that 2 similar companies with the same revenue and profit margins can report very different net income amounts. The reasons are that one company might be financed by a lot of debt and the other company might be financed by equity. The company that has debt would have interest payments that

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Business Price vs. Value... what's the difference??

“Price is what you pay for, value is what you get.” - Warren Buffet

There are many business valuation-related terms used that may lead to some confusion. This blog post will focus on clarifying some common misunderstandings. Specifically, this blog post will focus on clarifying some of the differences between business price vs. value.

What is business value? Is it the book value from a company's financial statements?

Most likely... not. A company's book value refers to the balance sheet value of a company. It is the company's balance sheet assets less its liabilities. On the balance sheet, asset values are normally listed at historic cost amounts and possibly some level of depreciation charged against them. They usually do not reflect the actual values that they can fetch on the marketplace.

If you were looking to sell a company you would most likely NOT sell it for its book value. The big reason for this is that book value does not include the economic goodwill of the business.

For instance, imagine a dental practice. The practice has all kinds of equipment, supplies, tools, computers, furniture and other items. However, if the business was bustling with an established patient roster and lots of revenue and profit then the dentist would not want to sell you the practice for merely the book value of the company. He or she would want some consideration for the patients that keep coming back to him and the reputation of the clinic. This is the economic goodwill.

So... book value is an accounting term. It is not true economic value.

There are many business valuation-related terms used that may lead to some confusion. This blog post will focus on clarifying some common misunderstandings. Specifically, this blog post will focus on clarifying some of the differences between business price vs. value.

What is business value? Is it the book value from a company's financial statements?

Most likely... not. A company's book value refers to the balance sheet value of a company. It is the company's balance sheet assets less its liabilities. On the balance sheet, asset values are normally listed at historic cost amounts and possibly some level of depreciation charged against them. They usually do not reflect the actual values that they can fetch on the marketplace.

If you were looking to sell a company you would most likely NOT sell it for its book value. The big reason for this is that book value does not include the economic goodwill of the business.

For instance, imagine a dental practice. The practice has all kinds of equipment, supplies, tools, computers, furniture and other items. However, if the business was bustling with an established patient roster and lots of revenue and profit then the dentist would not want to sell you the practice for merely the book value of the company. He or she would want some consideration for the patients that keep coming back to him and the reputation of the clinic. This is the economic goodwill.

So... book value is an accounting term. It is not true economic value.

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Monday 1 February 2016

The "Shotgun Clause" - what is it, and is it fair?

The shotgun clause is an often cited tool used in shareholder agreements to provide liquidity to shareholders. This blog post will briefly examine the shotgun clause and discuss some pros and cons.

What is a shotgun clause?

Simply stated, it is a type of buy/sell agreement between shareholders or partners in a business. The shotgun clause is usually added to a shareholders agreement in order to provide shareholders with liquidity in case one wants to exit the business or partnership. It is usually provided as an option of last resort in cases where the shareholders can't agree or have a significant difference of opinion and need to go their separate ways.

A simple example...

Sam and Tom are 50% partners in an incorporated business that manufactures desserts. Sam wants the company to focus on salty treats but Tom disagrees and thinks sweet treats are the way to go. The two shareholders are at an impasse. According to their shareholders' agreement, they are each entitled to call the shotgun clause in cases where they are at an impasse and need to go their separate ways. Therefore, due to his difference of opinion with Tom over sweet vs salty, Sam would like to use the shotgun clause in their shareholder agreement.

As a first step, Sam would need to set an offer price for Tom's shares.

After Sam offers a price to Tom for Tom's 50% of the company, Tom would then have the option of either:

What is a shotgun clause?

Simply stated, it is a type of buy/sell agreement between shareholders or partners in a business. The shotgun clause is usually added to a shareholders agreement in order to provide shareholders with liquidity in case one wants to exit the business or partnership. It is usually provided as an option of last resort in cases where the shareholders can't agree or have a significant difference of opinion and need to go their separate ways.

A simple example...

Sam and Tom are 50% partners in an incorporated business that manufactures desserts. Sam wants the company to focus on salty treats but Tom disagrees and thinks sweet treats are the way to go. The two shareholders are at an impasse. According to their shareholders' agreement, they are each entitled to call the shotgun clause in cases where they are at an impasse and need to go their separate ways. Therefore, due to his difference of opinion with Tom over sweet vs salty, Sam would like to use the shotgun clause in their shareholder agreement.

As a first step, Sam would need to set an offer price for Tom's shares.

After Sam offers a price to Tom for Tom's 50% of the company, Tom would then have the option of either:

- accepting Sam's offer or, instead,

- Tom could buy Sam's shares at the price that Sam had offered for Tom's shares.

Labels:

business valuation,

shotgun clause

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Monday 18 January 2016

10 Common Business Valuation Mistakes

This blog post will look at a sample of 10 mistakes that are often made in a business valuation.

#1. Unrealistic projections of revenue

One of the most common types of revenue projections is the classic “hockey stick” projection. This is a type of forecast where revenue suddenly shoot up in the forecast period by applying a suddenly high growth rate. There are obviously some concerns with this. Bear in mind that this is not to say that it's not possible for a company to follow a hockey stick revenue growth trajectory, but it does require some serious scrutiny.

Some questions that should be asked:

It is important to have a very close look at what is driving the growth in revenue. It would be prudent to look at the specific levers of growth to understand if they are realistic and sustainable. When a business valuation simply

#1. Unrealistic projections of revenue

One of the most common types of revenue projections is the classic “hockey stick” projection. This is a type of forecast where revenue suddenly shoot up in the forecast period by applying a suddenly high growth rate. There are obviously some concerns with this. Bear in mind that this is not to say that it's not possible for a company to follow a hockey stick revenue growth trajectory, but it does require some serious scrutiny.

Some questions that should be asked:

- is the growth in line with the industry?

- what is the size of the market?

- what is the company's strategy to achieve this growth?

- what is the economic outlook for the region the company operates in?

- what is driving the growth? Is it new customer acquisition... increase in market share.... acquisitions... innovation... new product offering?

- how sustainable is it?

It is important to have a very close look at what is driving the growth in revenue. It would be prudent to look at the specific levers of growth to understand if they are realistic and sustainable. When a business valuation simply

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Sunday 17 January 2016

How to Calculate the Equity Risk Premium in a Business Valuation

Slightly wonkish blog post on equity returns ahead....

When valuing a privately held business, it is important to properly calculate the business’s total cost of capital in order to correctly capitalize or discount its cashflow. The basic premise of business valuation is that a business is worth the present value of its future cashflow, therefore discounting the future cashflow of the business at the appropriate discount rate is crucial.

What is the cost of capital for a business?

The weighted average cost of capital is the discount rate most often used to discount the future cashflow of a business. It reflects the time value of money and risk associated with the business’s future stream of unlevered cashflow (cashflow that accrues to equity holders and debt holders).

A business's capital structure is composed of its debt and its equity. Determining the company's total cost of capital basically entails taking its cost of debt (which is usually an interest rate) and its cost of equity (to be discussed below) and then taking the weighted average of the two based on the company's optimal capital structure (this is called the weighted average cost of capital, the WACC). Without getting too wonky (too late), it's very important to properly calculate this because the WACC is used to present value or capitalize the future cashlfows of the business, which is the key step in a business valuation.

So.... if your WACC is wrong then your business valuation conclusion can't be right. This post will look at the equity risk premium, which is a component of the total cost of equity which, in turn, is used to calculate the total cost of capital for a business.

Let's back up one step - what is the cost of equity??

The cost of equity is simply the return that equity investors expect to make on their investment in a business.

When valuing a privately held business, it is important to properly calculate the business’s total cost of capital in order to correctly capitalize or discount its cashflow. The basic premise of business valuation is that a business is worth the present value of its future cashflow, therefore discounting the future cashflow of the business at the appropriate discount rate is crucial.

What is the cost of capital for a business?

The weighted average cost of capital is the discount rate most often used to discount the future cashflow of a business. It reflects the time value of money and risk associated with the business’s future stream of unlevered cashflow (cashflow that accrues to equity holders and debt holders).

A business's capital structure is composed of its debt and its equity. Determining the company's total cost of capital basically entails taking its cost of debt (which is usually an interest rate) and its cost of equity (to be discussed below) and then taking the weighted average of the two based on the company's optimal capital structure (this is called the weighted average cost of capital, the WACC). Without getting too wonky (too late), it's very important to properly calculate this because the WACC is used to present value or capitalize the future cashlfows of the business, which is the key step in a business valuation.

So.... if your WACC is wrong then your business valuation conclusion can't be right. This post will look at the equity risk premium, which is a component of the total cost of equity which, in turn, is used to calculate the total cost of capital for a business.

Let's back up one step - what is the cost of equity??

The cost of equity is simply the return that equity investors expect to make on their investment in a business.

Labels:

business valuation,

cost of capital,

cost of equity

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Wednesday 13 January 2016

Business Valuation for Tax & Estate Planning

This blog post will discuss the concept of an estate freeze, which is a commonly used tax and estate planning tool. We will also discuss how an independent business valuation is an important part of that process.

What's an estate freeze?

Section 86 of the Income Tax Act allows for the tax-free exchange of shares in specific instances. It is commonly used for estate planning purposes. Section 86 generally allows for the transfer of one's shares to be done at fair market value, tax free. Generally, the owner of an operating company can exchange their common shares for preferred shares at fair market value and then issue new common shares to a person (such as a child) and then the child's common share value would be based on the growth in value of the company. At a high level, this is what is referred to as an estate freeze.

A simple example –

Suppose a single mother (Mrs. Smith) is the sole shareholder of her company that she started up from scratch over 20 years ago using her hard work and sweat (BusinessCo Inc.). BusinessCo Inc. is now a highly successful service company and Mrs. Smith's shares are worth $1 million today, according to a recent business valuation she had. Based on the company's

What's an estate freeze?

Section 86 of the Income Tax Act allows for the tax-free exchange of shares in specific instances. It is commonly used for estate planning purposes. Section 86 generally allows for the transfer of one's shares to be done at fair market value, tax free. Generally, the owner of an operating company can exchange their common shares for preferred shares at fair market value and then issue new common shares to a person (such as a child) and then the child's common share value would be based on the growth in value of the company. At a high level, this is what is referred to as an estate freeze.

A simple example –

Suppose a single mother (Mrs. Smith) is the sole shareholder of her company that she started up from scratch over 20 years ago using her hard work and sweat (BusinessCo Inc.). BusinessCo Inc. is now a highly successful service company and Mrs. Smith's shares are worth $1 million today, according to a recent business valuation she had. Based on the company's

Labels:

business valuation,

estate planning,

succession planning,

tax

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Saturday 9 January 2016

Business Valuation and the Risk Free Rate

Government bond yields are at historic low levels in Canada and across

the developed world (see the table below that charts the yield of the

10-year Government of Canada bond, over a 5 year period). This has very

important implications on the values of businesses (and other assets

too, but this post will stick to commenting on business equity values).

This blog post will examine the impact that historically low risk free

rates have on the cost of equity in a business valuation.

What’s the risk free rate?

Simply stated, the risk free rate is the theoretical return that would be earned on a theoretical investment that has no risk of loss. In other words if you invested money into a risk free investment there would be zero risk of loss to you. Government bond yields (in rich, developed countries) are usually used as a proxy for the risk free rate as these bonds are thought to be without risk to investors. Some people may dispute this notion, especially after listening to the congressional debate about the debt ceiling in the United States. As an aside, the real risk free rate is probably even lower than government bond yields since sovereign risk has likely

What’s the risk free rate?

Simply stated, the risk free rate is the theoretical return that would be earned on a theoretical investment that has no risk of loss. In other words if you invested money into a risk free investment there would be zero risk of loss to you. Government bond yields (in rich, developed countries) are usually used as a proxy for the risk free rate as these bonds are thought to be without risk to investors. Some people may dispute this notion, especially after listening to the congressional debate about the debt ceiling in the United States. As an aside, the real risk free rate is probably even lower than government bond yields since sovereign risk has likely

Labels:

business valuation,

cost of capital

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Friday 8 January 2016

Taxation Issues in Business Valuation

A business valuation engagement triggers many questions about how taxes may impact the valuation. This blog post will touch on some of the more common tax considerations that arise in a business valuation engagement.

The first important question is -- what is the valuation approach? Is the business a going concern or is it a liquidation situation?

Going Concern Approach

If the business is viable and is a going concern, the following are some more common tax issues that come up in a business valuation:

What is the type of corporation?

Is the business a partnership, a joint venture, a Canadian Controlled Private Corporation (CCPC), private corporation, public corporation, and so on..? The type of corporation it is will impact the level of taxation.

There could be a situation where the business was incorporated as a CCPC and is entitled to the small business deduction and therefore would be taxed at a lower rate. However, it may be determined that after a purchase that it would no longer be a CCPC and not entitled to the small business deduction and therefore the tax rate would be higher. If this is known in advance then the tax rate used in the valuation should not include the small business deduction. If it is not known with a high degree of certainty then the business valuator would have to apply the most reasonable income tax rate to the valuation.

Tax implications in an income-based valuation approach

In an income approach business valuation, the future cashflows of the business are forecasted and discounted to the present value using a discount rate to account for risk and the time value of money. This is referred to as the income approach. Sometimes a cashflow at a single point in time is capitalized (with a growth rate

The first important question is -- what is the valuation approach? Is the business a going concern or is it a liquidation situation?

Going Concern Approach

If the business is viable and is a going concern, the following are some more common tax issues that come up in a business valuation:

What is the type of corporation?

Is the business a partnership, a joint venture, a Canadian Controlled Private Corporation (CCPC), private corporation, public corporation, and so on..? The type of corporation it is will impact the level of taxation.

There could be a situation where the business was incorporated as a CCPC and is entitled to the small business deduction and therefore would be taxed at a lower rate. However, it may be determined that after a purchase that it would no longer be a CCPC and not entitled to the small business deduction and therefore the tax rate would be higher. If this is known in advance then the tax rate used in the valuation should not include the small business deduction. If it is not known with a high degree of certainty then the business valuator would have to apply the most reasonable income tax rate to the valuation.

Tax implications in an income-based valuation approach

In an income approach business valuation, the future cashflows of the business are forecasted and discounted to the present value using a discount rate to account for risk and the time value of money. This is referred to as the income approach. Sometimes a cashflow at a single point in time is capitalized (with a growth rate

Labels:

business valuation,

tax

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Subscribe to:

Posts (Atom)